The profitable debut of the REX-Osprey Solana ETF and the rising likelihood of a spot Solana ETF approval have intensified discussions about what comes subsequent. As Solana climbs the institutional ladder, the highlight turns to different altcoins that might observe its path into the ETF enviornment. XRP, Cardano (ADA), and Avalanche (AVAX) are among the many high contenders.

The Ripple Impact: Why Solana Opens the Door

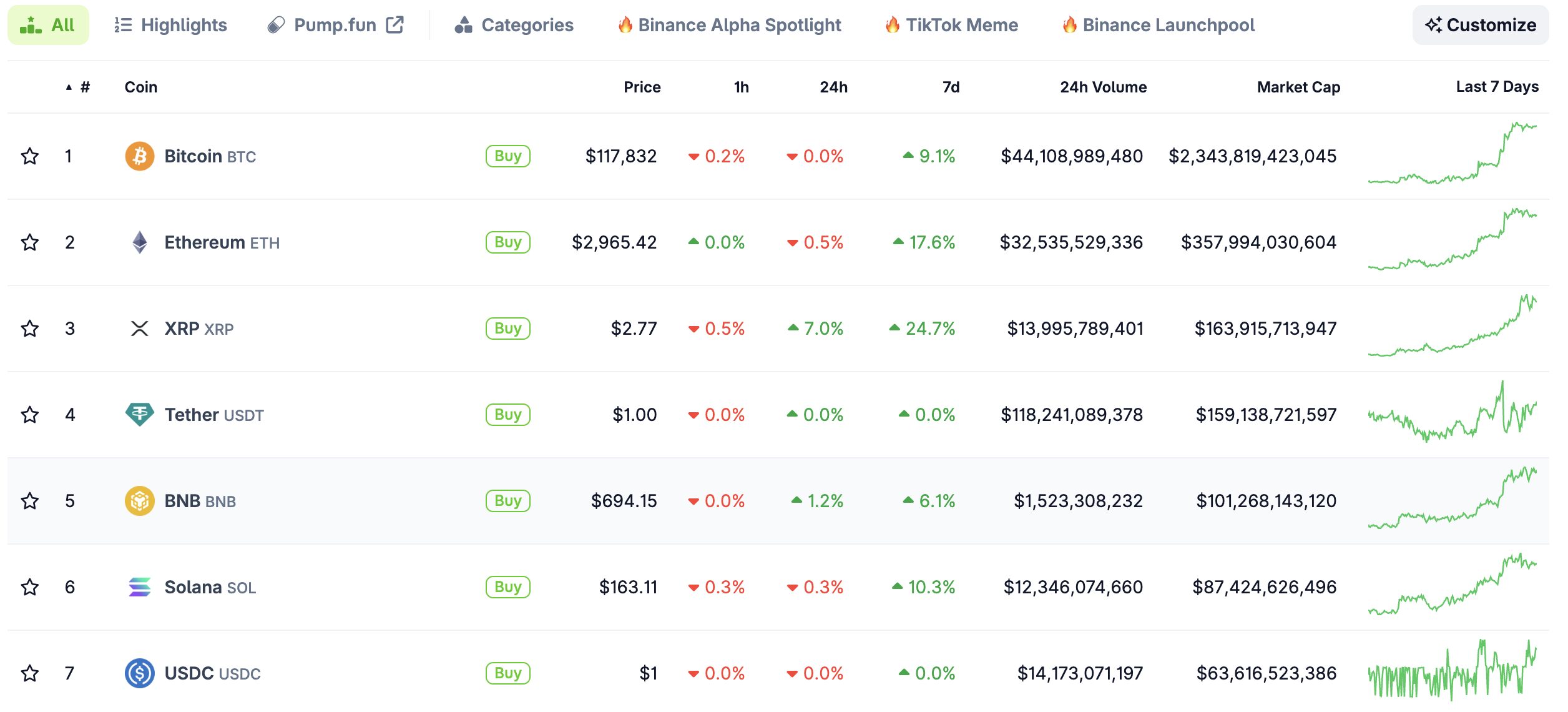

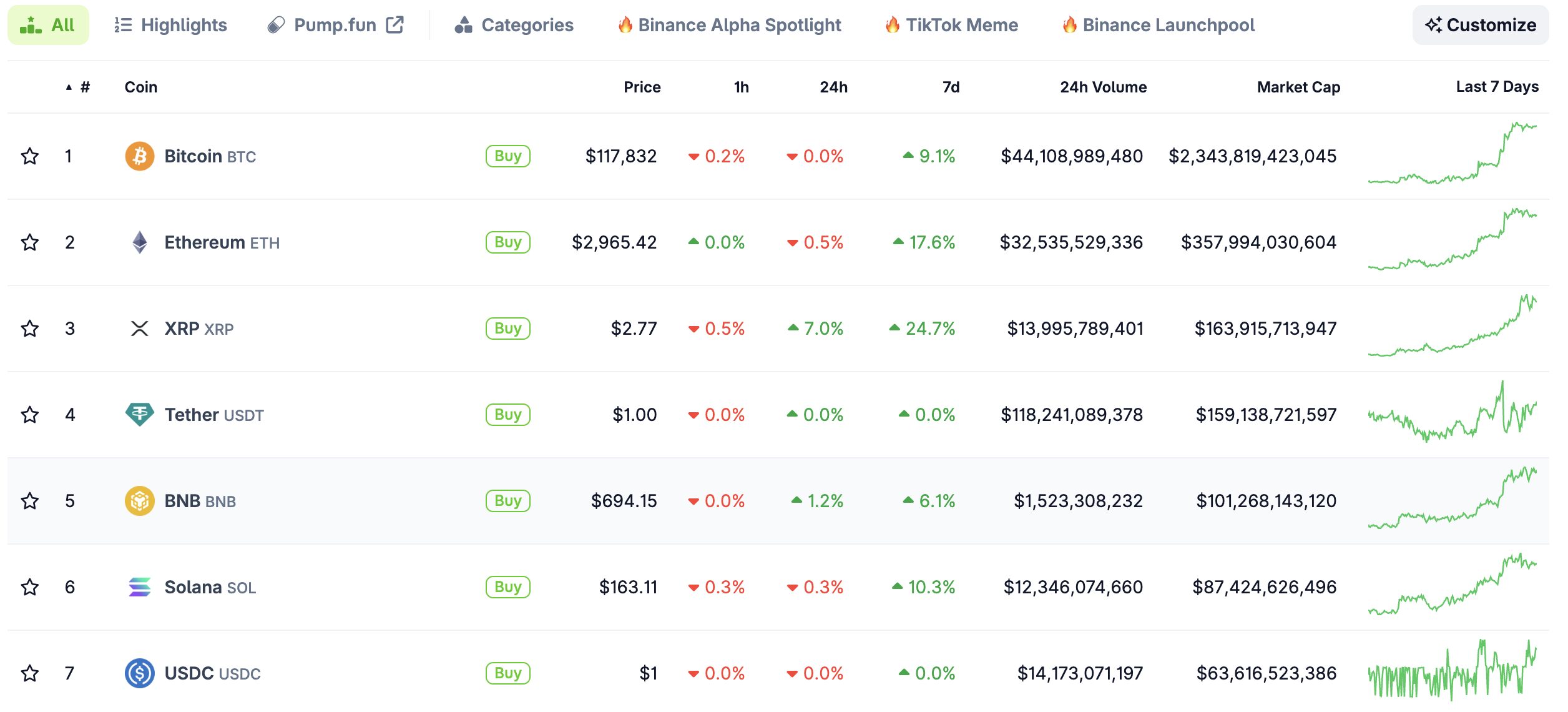

Solana’s ETF breakthrough is not only a win for its ecosystem — it units a starting step for different altcoins. After Bitcoin and Ethereum ETFs have been accepted based mostly on their commodity-like standing and deep liquidity, Solana grew to become the primary altcoin past the “Large Two” to satisfy the dialog threshold. As of July 2025, Solana ranks #6 by market cap at over $67 billion, with each day buying and selling volumes averaging $2.5 billion throughout main exchanges.

Supply: Coingecko

Furthermore, with over 2,400 energetic validators and excessive throughput, at as much as 65,000 TPS as introduced, have made Solana a superb consideration within the eyes of institutional buyers. The SEC’s latest request for amended S-1 filings for spot Solana ETFs — with a delicate deadline of July 31 — indicators the regulatory door is opening wider, probably establishing a framework that altcoins like XRP, ADA, and AVAX might observe.

For extra: Solana ETF: VanEck, REX-Osprey & the Street Forward

XRP: The Darkish Horse with Authorized Readability

XRP could possibly be seen as essentially the most notable case when referring to altcoin ETFs. It’s the most legally clarified asset within the altcoin ETF dialogue. In July 2023, a U.S. federal courtroom dominated that XRP gross sales on secondary markets don’t represent securities transactions, a partial victory that Ripple Labs capitalized on. Whereas the ruling didn’t totally absolve Ripple from regulatory scrutiny, it successfully eliminated one of many largest authorized boundaries to institutional merchandise based mostly on XRP.

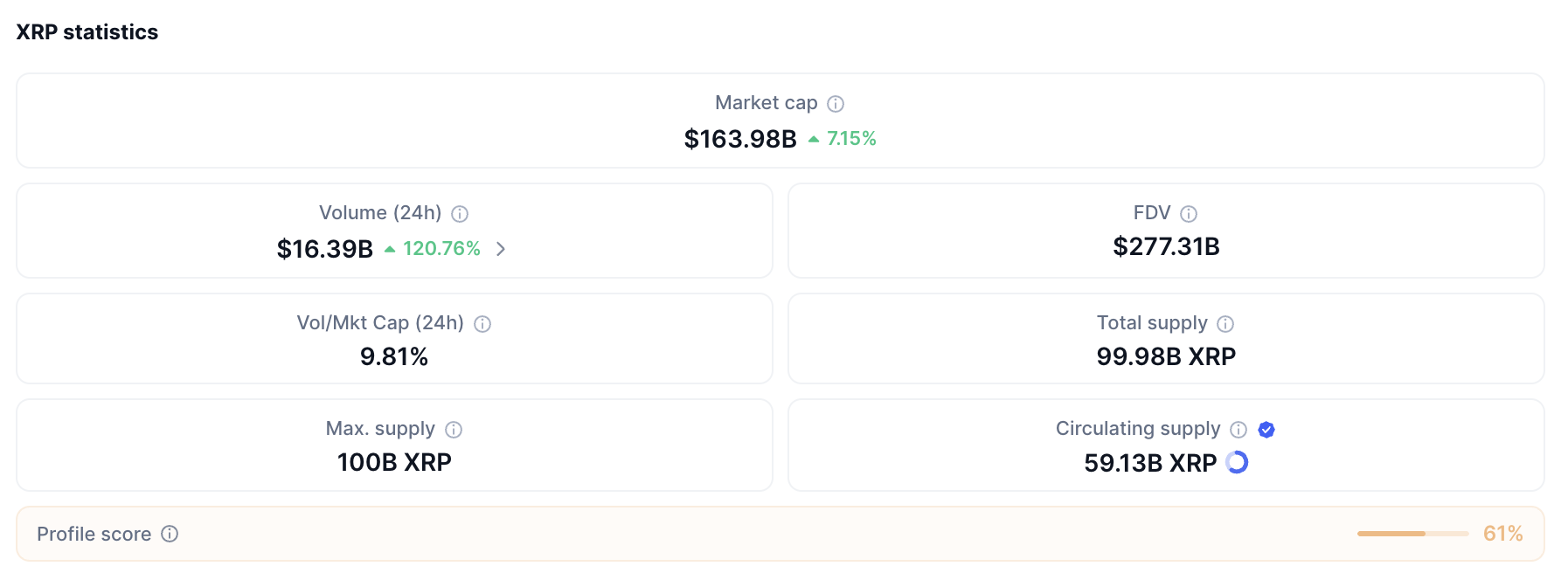

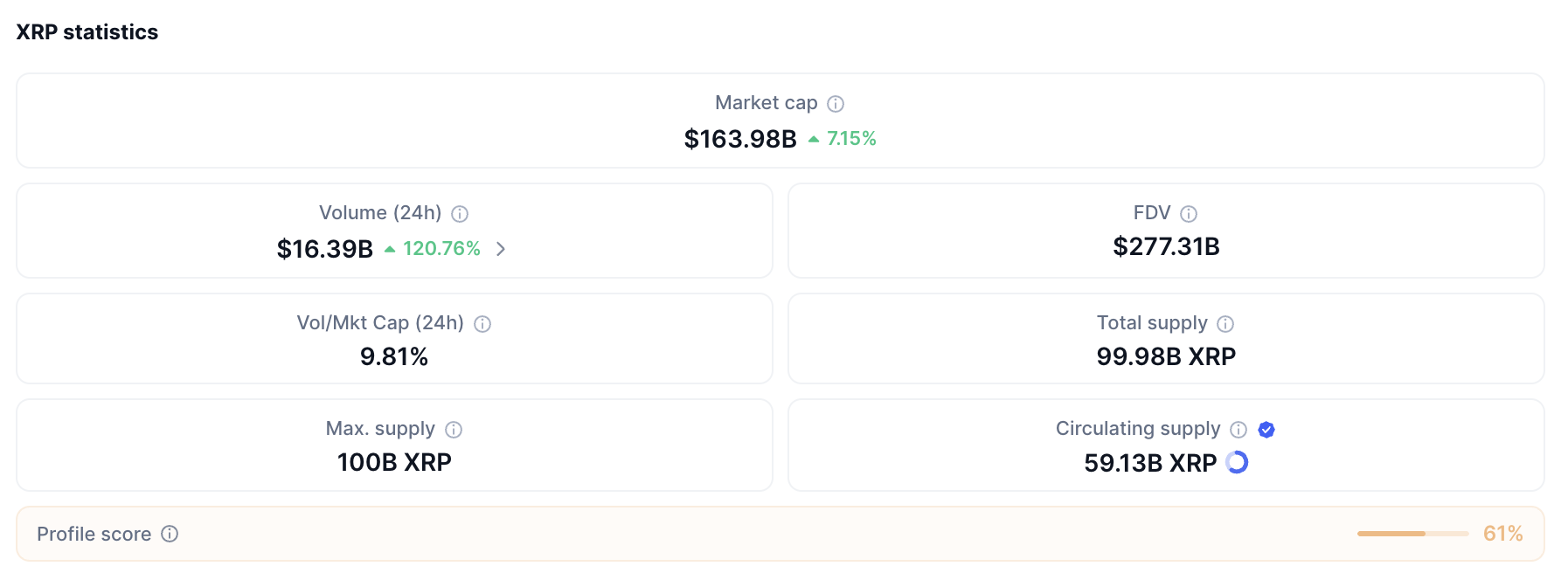

Supply: CoinMarketcap

XRP’s liquidity metrics are sturdy. As of Q2 2025, XRP sees each day volumes exceeding $1.2 billion and is listed on over 100 exchanges globally. Its use case in cross-border funds continues to be validated, with RippleNet processing over $15 billion in remittance quantity yearly throughout areas like Asia and Latin America, in line with the Ripple Transparency Report.

With its authorized readability, deep liquidity, and current institutional footprint, XRP is arguably essentially the most ETF-ready altcoin — pending a shift in SEC posture towards post-Solana altcoin merchandise.

For extra: XRP Deep Dive: A Complete Evaluation of Ripple Impact

Cardano (ADA): A Lengthy-Time period Wager on Fundamentals

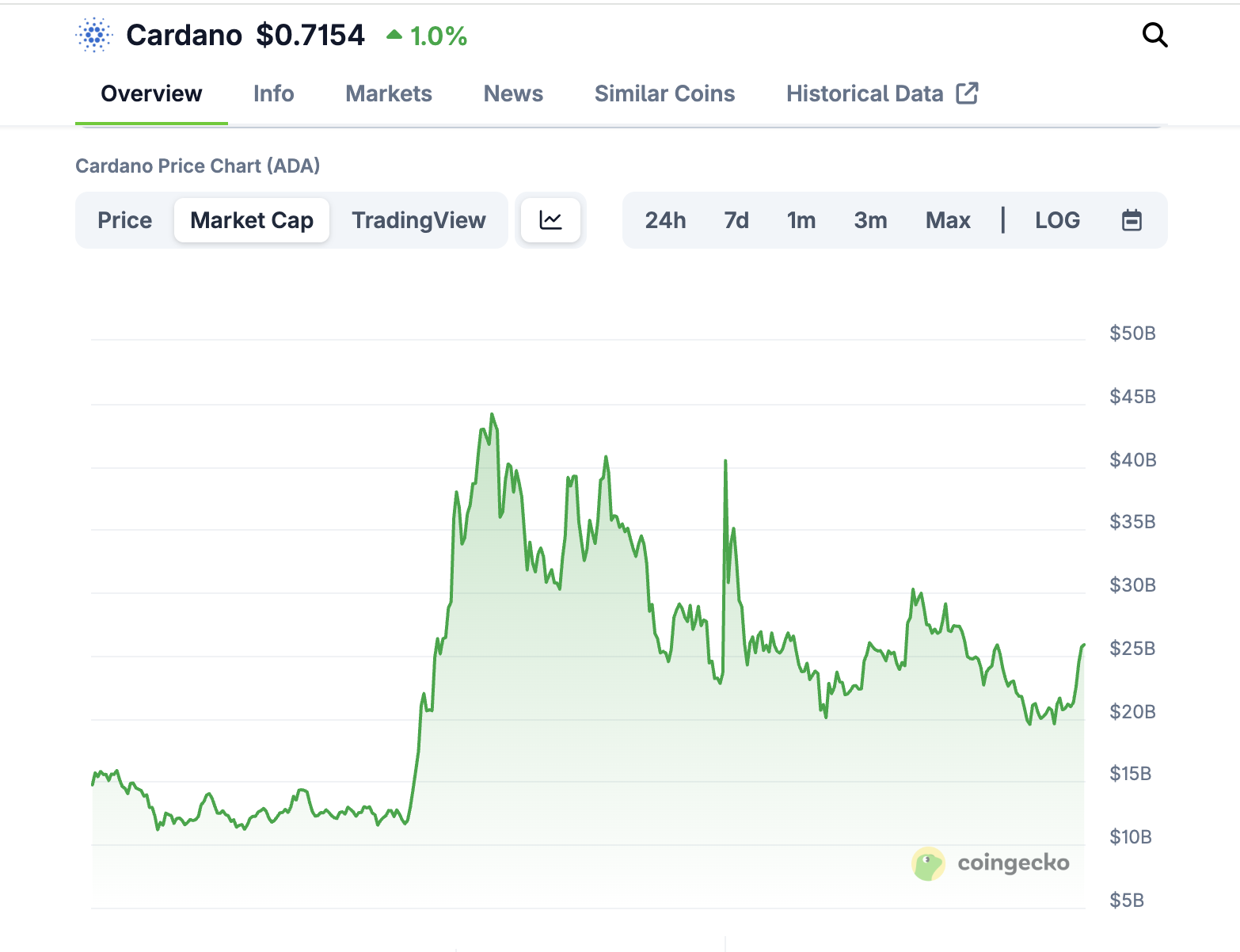

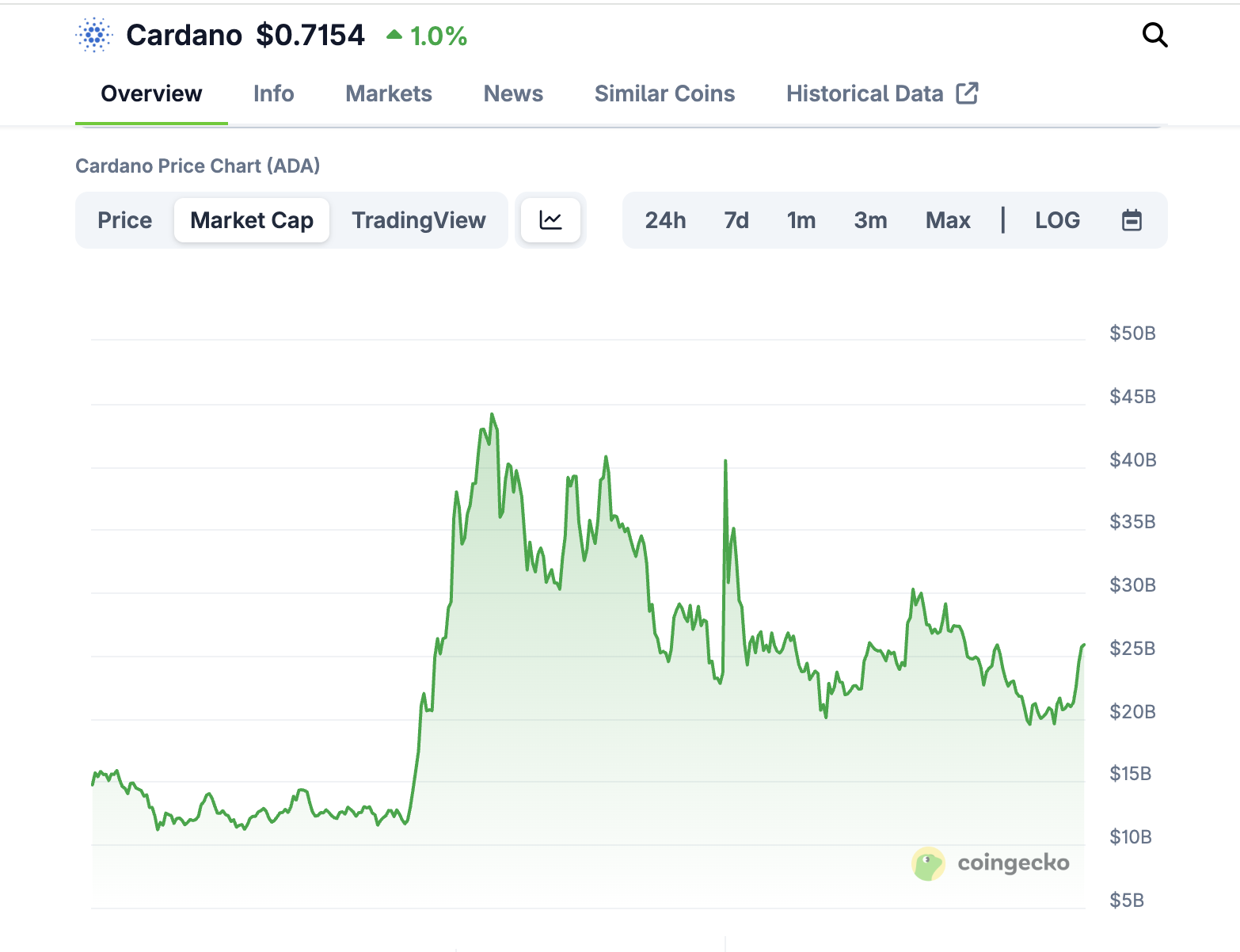

Cardano is a powerful title on this listing. It’s seen because the “sluggish and regular” contender. Its research-first philosophy, rooted in peer-reviewed tutorial papers and formal verification, makes it interesting to institutional buyers searching for technical rigor. With a present market cap of $25 billion, ADA ranks among the many high 20 cryptocurrencies, and its staking ecosystem contains over 3,200 stake swimming pools, highlighting sturdy decentralization.

Spurce: Coingecko

Nonetheless, Cardano’s on-chain exercise lags behind Solana and Ethereum. Based on Coingecko metrics, each day transaction quantity for ADA in June 2025 was roughly $2.6 billion, roughly to Solana’s $2.5 billion. Its DeFi TVL stays modest at simply over $400 million, limiting its case for monetary utility in comparison with faster-growing chains.

Supply: DefiLlama

But, within the eyes of conservative allocators, ADA’s long-term imaginative and prescient for governance, scalability (by way of Hydra), and interoperability might function a basis for ETF viability — notably as broader altcoin laws mature.

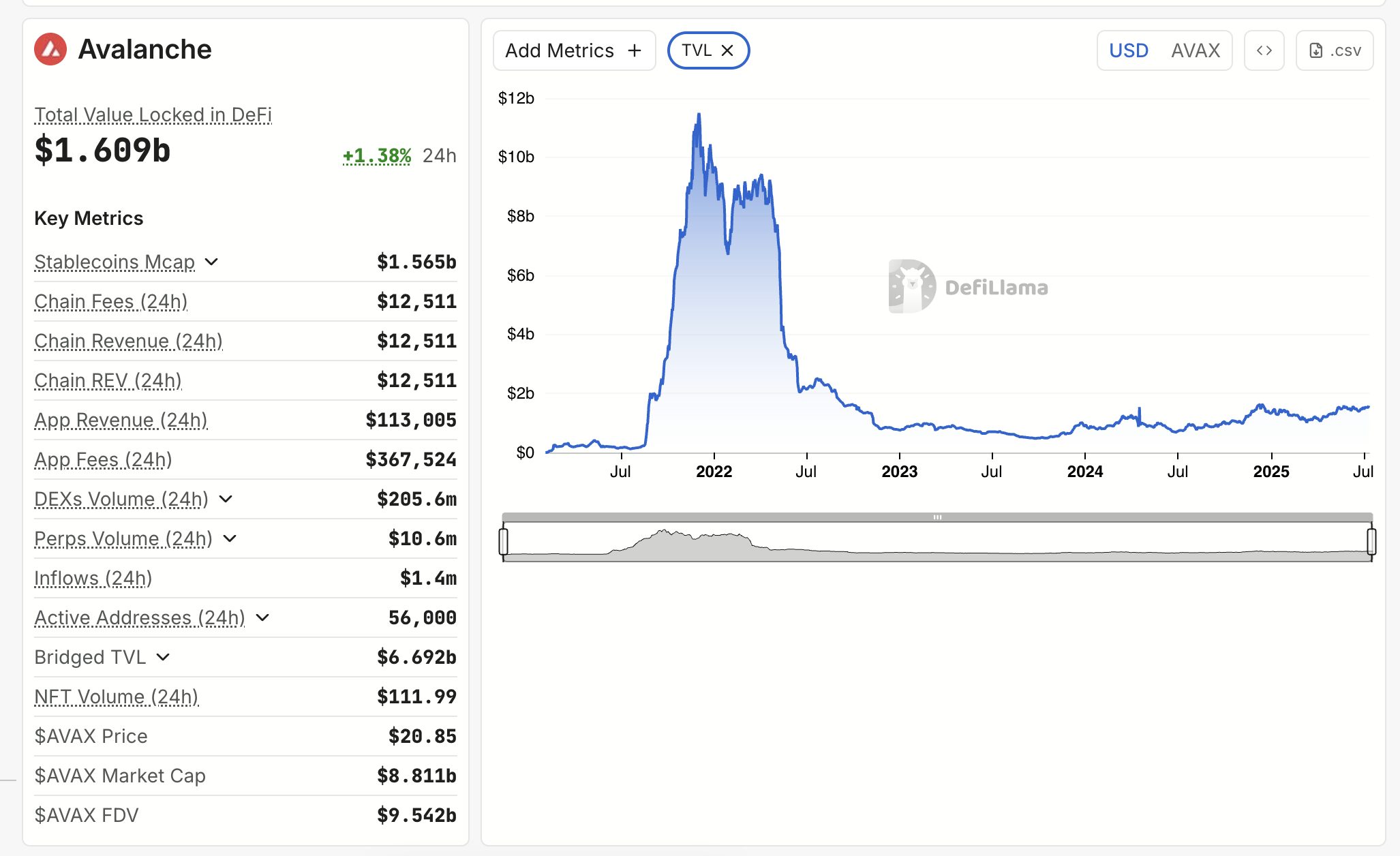

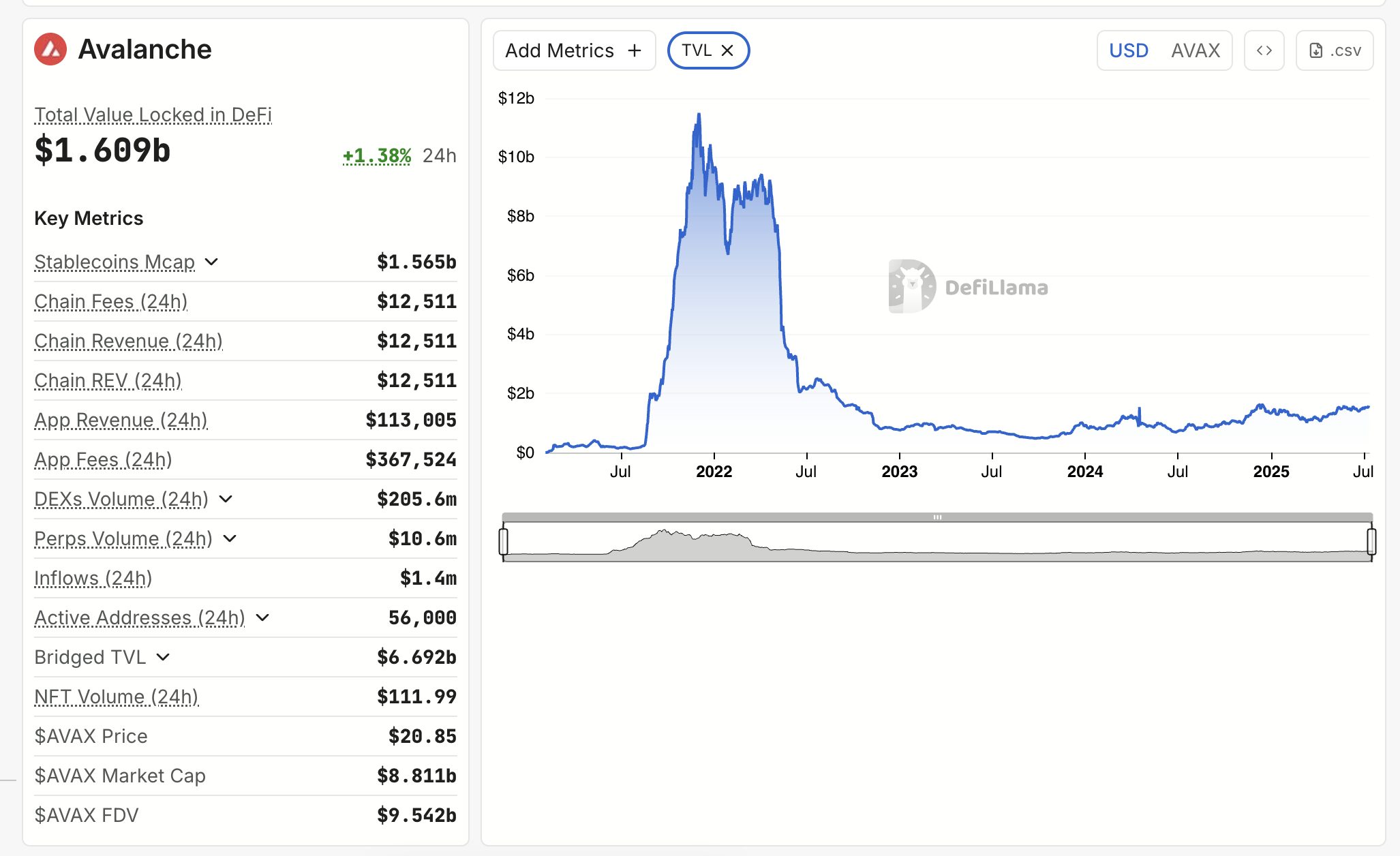

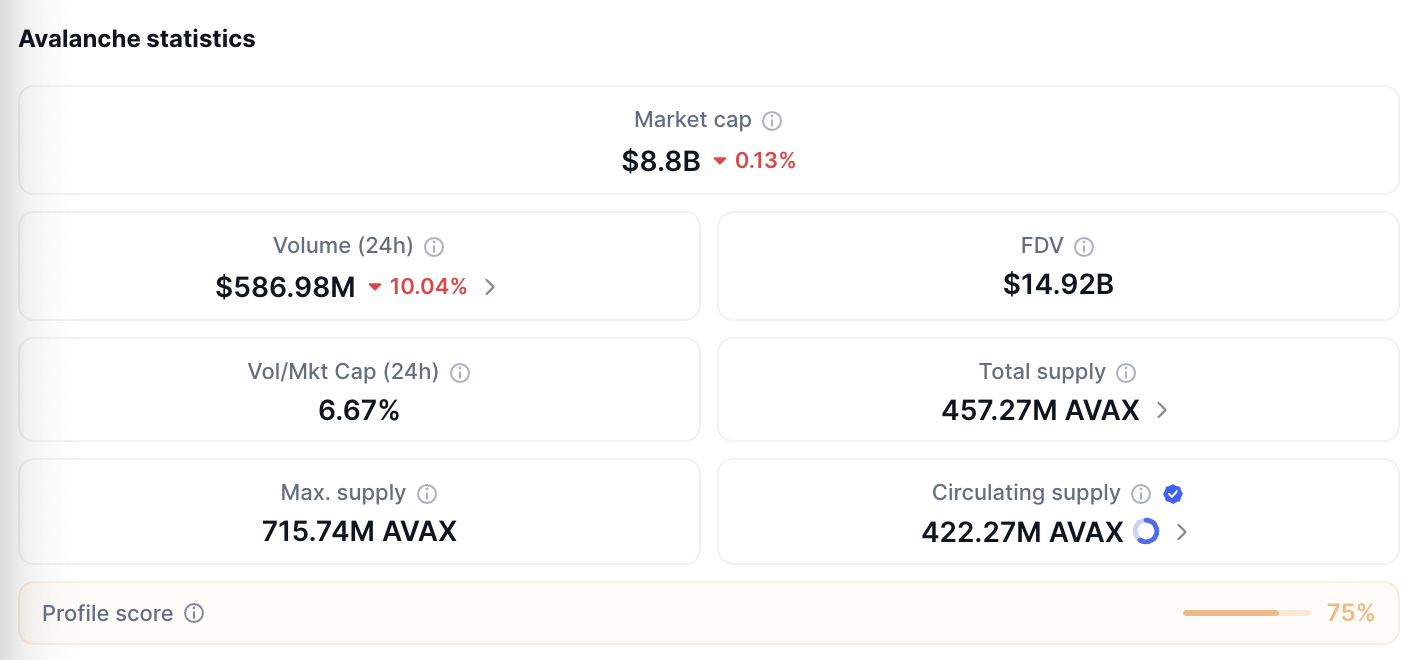

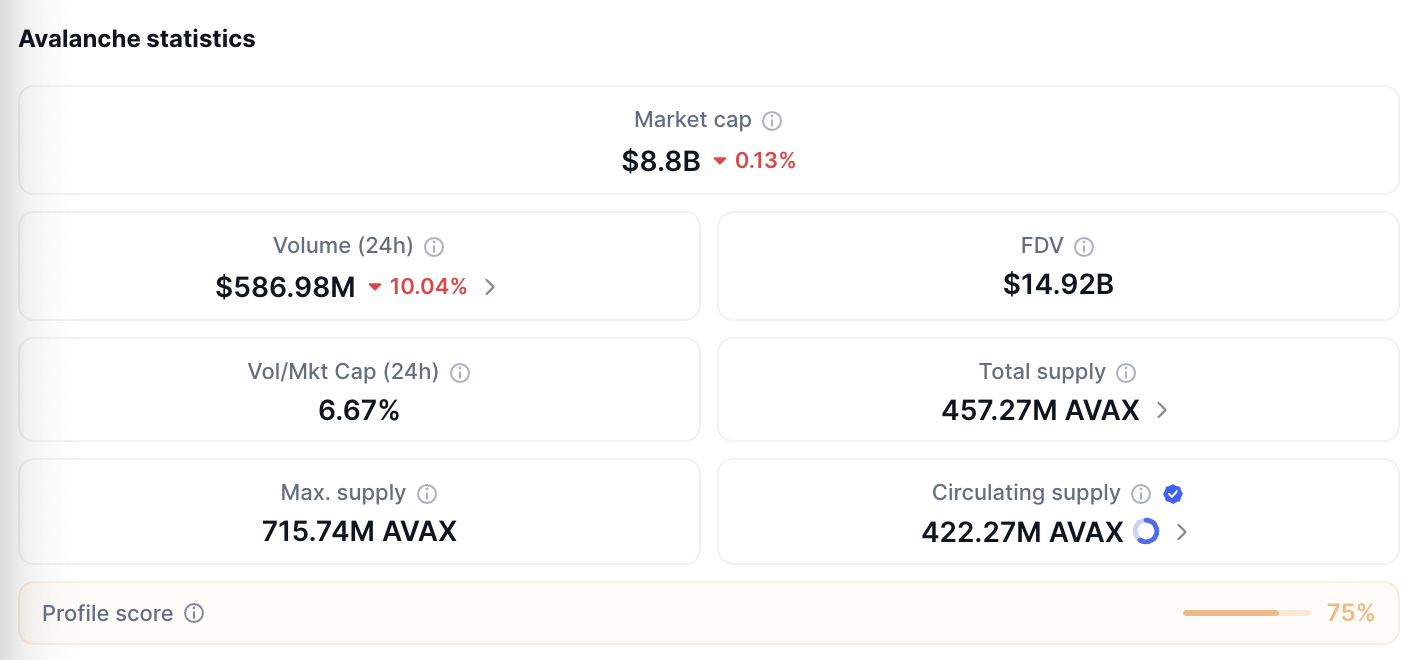

Avalanche (AVAX): The Enterprise-Pleasant Contender

Last within the listing, Avalanche stands out for its modular design and enterprise attraction. With its distinctive subnet structure, AVAX allows establishments to create customized, permissioned chains — a key differentiator in discussions round compliance-ready blockchain infrastructure. As of July 2025, Avalanche helps over 120 subnets and has partnered with corporations like Amazon Internet Providers and JPMorgan on blockchain pilots.

Supply: DefiLlama

When it comes to metrics, AVAX instructions a market cap of $8.8 billion, with a DeFi TVL of $1.6 billion, rating it throughout the high 6 within the DeFi area. Each day transaction quantity throughout Avalanche’s C-Chain averages $600 million. Its give attention to real-world asset tokenization — such because the initiative with Intain and JPM — locations it in a major place for institutional traction.

Supply: CoinMarketcap

Whereas AVAX doesn’t but have the authorized readability of XRP or the retail cult standing of Solana, its enterprise-first narrative might match effectively into multi-asset ETF merchandise or bespoke institutional autos in regulated markets.

What the SEC Seems to be For

The SEC’s method to ETF approvals has traditionally centered on market maturity, investor safety, and surveillance sharing agreements. For altcoins to qualify, they need to meet a number of unwritten standards:

- Adequate buying and selling quantity on regulated U.S. exchanges

- Demonstrable decentralization and safety

- Readability on token classification (i.e., not a safety)

- Potential for value discovery and arbitrage throughout venues

At the moment, not one of the altcoins talked about have CFTC-regulated futures markets, which was a pivotal issue within the approval of Bitcoin and Ethereum ETFs. This stays the largest hurdle. Nonetheless, a profitable Solana ETF might recalibrate the SEC’s benchmarks, notably if it contains staking, on-chain rewards, or DeFi interactions.

Would love to listen to instantly from Atkins, however all good probability of occurring. Right here’s our newest odds of approval for all of the dif spot ETFs by way of @JSeyff https://t.co/nLhYJJmO9U pic.twitter.com/4AcJVwhics

— Eric Balchunas (@EricBalchunas) April 30, 2025

Based on Bloomberg Intelligence, the percentages of a Solana ETF approval by the tip of 2025 are above 90%. If that approval materializes, it could virtually definitely set off a reassessment of XRP, ADA, and AVAX ETF proposals by each issuers and regulators.

The Position of Multi-Asset Crypto ETFs

One other probably improvement post-Solana is the approval of diversified crypto ETFs that embody a number of altcoins. These could supply publicity to a basket of digital property, weighted by market cap or ecosystem energy. Corporations like Constancy and Bitwise have explored such ideas, proposing index-style ETFs that cut back single-asset threat whereas complying with SEC necessities.

This construction could possibly be a workaround for altcoins which are individually not prepared for standalone ETFs. It additionally displays rising investor curiosity in broad-based crypto publicity with out the complexity of managing a number of wallets and exchanges.

For extra: Tokenized Shares: The Way forward for Equities on the Blockchain

Last rating for ETF potential (as of mid-2025)

Based mostly on accessible information and regulatory concerns, XRP at present seems to have the strongest probability of receiving ETF approval following Solana. The partial courtroom ruling in 2023 established that XRP, when traded on secondary markets, isn’t thought-about a safety—granting it a degree of authorized readability that almost all different altcoins lack. XRP additionally advantages from deep liquidity, constant alternate assist, and a well-established use case in cross-border funds.

Avalanche (AVAX) is one other sturdy contender, providing modular structure, excessive developer exercise, and rising adoption amongst enterprise customers. Though AVAX lacks the identical authorized readability as XRP, its real-world integrations and strong ecosystem make it enticing for diversified or thematic ETF merchandise.

Cardano (ADA), whereas extremely decentralized and academically rigorous, faces challenges in each day transaction quantity, DeFi exercise, and community utilization, that are metrics usually scrutinized by regulators. In consequence, ADA could also be seen as a longer-term candidate. In abstract, XRP leads on authorized readability and infrastructure, AVAX stands out in innovation and enterprise readiness, whereas ADA stays sturdy on fundamentals however could require additional market maturity earlier than ETF consideration.

Last rating for ETF potential (as of mid-2025):

| Rank | Altcoin | ETF Viability | Major Power | Predominant Impediment |

| 1 | XRP | Excessive | Authorized readability & liquidity | Historic regulatory baggage |

| 2 | AVAX | Medium | Enterprise adoption & TVL | No authorized readability or futures |

| 3 | ADA | Low–Medium | Decentralization & governance | Low exercise & TVL |

Conclusion

Solana’s breakthrough into the ETF area has created a ripple impact throughout the altcoin market. XRP, ADA, and AVAX every supply compelling—but distinct—instances for changing into the subsequent ETF-approved asset. Whereas regulatory and structural hurdles stay, momentum is clearly constructing. Whether or not by means of single-asset autos or multi-asset crypto ETFs, the post-Solana period could lastly unlock a brand new section of altcoin accessibility for institutional and retail buyers alike.